What Does The Term Money Laundering Mean In Business

The concept of cash laundering is essential to be understood for these working in the monetary sector. It is a process by which soiled money is transformed into clean money. The sources of the money in actual are felony and the cash is invested in a way that makes it seem like clean money and hide the id of the criminal part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the brand new customers or sustaining existing customers the obligation of adopting ample measures lie on every one who is a part of the organization. The identification of such element to start with is straightforward to deal with instead realizing and encountering such conditions afterward in the transaction stage. The central bank in any nation gives complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to deter such situations.

Money laundering is the act of disguising the source of money obtained via illegal means. These actions make it more difficult for the authorities to trace the money back to the crime.

How Money Laundering Works Howstuffworks

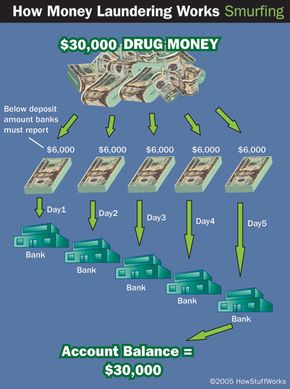

Another option is to convert the cash into negotiable instruments such as cashiers checks money orders or travelers checks.

What does the term money laundering mean in business. Its an indeed a catchy. Money laundering can be understood as an act of concealing the identity or source of money obtained illegally to make them appear to have obtained out of legal sources. Not only does it allow criminals to hide the proceeds of their illegal activities it can also destroy the economy harm honest taxpayers and pose many risks to your business.

About Business Crime Solutions - Money Laundering. Money laundering is the process of concealing illicit sources of money to make it appear like legitimately earned money. In many cases an illegal enterprise as the IRS calls them is attempting to make dirty money from these illegal activities such as a drug deal for example look legitimate clean that is.

This money is casually referred to as dirty money. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Money laundering is damaging in many ways.

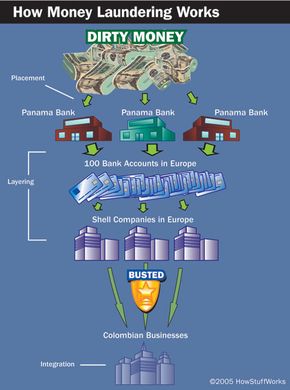

A Three-Stage Process Smurfs - A popular method used to launder cash in the placement stage. What makes more sense is that the term laundering was chosen because money laundering does what its name suggests. In the money laundering lexicon the term refers to jurisdictions deemed favorable to foreign investments because of low or no taxation or strict bank secrecy regulations.

It cleans the illegally obtained money making them look as if they were generated by legitimate businesses. Different jurisdictions both foreign and domestic have their own specific definitions of what acts constitute the crime of money laundering. Mafia groups have made huge amounts of extortion gambling etc.

You can decide which areas of your. Money laundering is a way to conceal illegally obtained funds. The term laundering comes from the fact that criminals disperse the money gained from the crime by spreading it out investing in businesses dividing it up into many bank accounts and so on.

By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits. That is a business such as a check-cashing service or a jewelry store. Therefore money laundering means running the money through a number of legitimate businesses before depositing it.

Hence the money is laundered. To disguise criminal activity launderers route cash through a front operation. Money which is evidently the proceeds of a crime is referred to as dirty money and money which has been laundered to appear legitimate is referred to as clean money.

Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. The term money laundering originated from the Mafia group in the United States of America. Offshore Banking License A license that prohibits a bank from doing business with local citizens or in local currency as a condition of its license.

And this money is shown as legal money. Simply put money laundering is the process of disguising the origin ie. Money laundering is transactions and activities used to hide the real source of money.

Because the act is specifically used to hide illegally obtained money it too is unlawful. Money laundering works by transferring money in elaborate and complicated financial transactions which mislead anyone who. The source from which money is received due to criminal activity changing its form and transferring them into a location where they are less.

To put it more simply its the act of hiding money. Allowing money laundering to take place through your business can leave you prone to challenges in managing your assets.

About Business Crime Solutions What Is Money Laundering

Money Laundering Overview How It Works Example

Money Laundering Define Motive Methods Danger Magnitude Control

What Is Money Laundering Amlc Eu

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Anti Money Laundering Overview Process And History

What Is Money Laundering And How Does It Work

Cryptocurrency Money Laundering Explained Bitquery

What Is Money Laundering And How Is It Done

How Money Laundering Works Howstuffworks

How Money Laundering Works Howstuffworks

What Is Money Laundering And How Is It Done

Understanding Money Laundering European Institute Of Management And Finance

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

The world of rules can appear to be a bowl of alphabet soup at times. US money laundering regulations are no exception. We've compiled a list of the highest ten money laundering acronyms and their definitions. TMP Threat is consulting agency focused on defending financial services by decreasing threat, fraud and losses. We have big financial institution expertise in operational and regulatory danger. We have now a strong background in program management, regulatory and operational risk as well as Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many opposed penalties to the group because of the dangers it presents. It increases the probability of major dangers and the opportunity value of the bank and ultimately causes the bank to face losses.